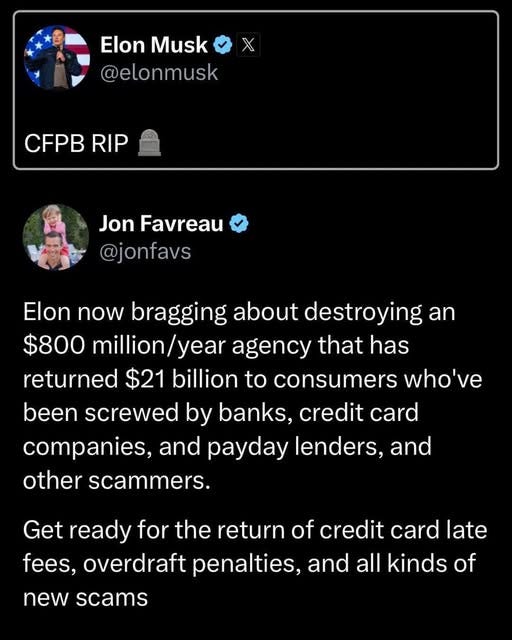

The CFPB Has Fallen: Prepare for Financial Carnage

With Consumer Protections Dead, Expect More Debt, More Fraud, and No Accountability

I spent a couple of days thinking about our latest administrative follies featuring Elon Musk and Donald Trump. I wondered what was all of the executive orders written by Trump and the blockading of government buildings by Elon Musk was all about. It felt performative, as if they were trying to hide something, the way a magician misdirects you even as he assures you nothing’s wrong.

If you get nothing else from this article I want you to think about this:

I want you to get your economic affairs in order because if the Project 2025 expectations are to be considered, the deregulation of financial services is on the menu. I am going to call this particular bit of legerdemain part of a criminal enterprise. No one else finds it suspicious that the author of Project 2025, Russ Vought is now the head of the Consumer Financial Protection Bureau?

Recent developments indicate significant changes at the Consumer Financial Protection Bureau (CFPB). Russell Vought, recently appointed as the acting director, has ordered the agency to cease all supervision and examination activities, halt stakeholder engagement, and suspend new investigations and public communications. Additionally, the CFPB's funding from the Federal Reserve has been cut off, leading to the agency’s website displaying an error message.

These actions align with the objectives outlined in Project 2025, a conservative policy agenda developed by the Heritage Foundation, which advocates for restructuring federal agencies and reducing regulatory oversight. In essence, they are gutting the agency that was created in the wake of the 2008 financial crisis—the very agency meant to protect consumers from predatory lenders, abusive credit card practices, and fraudulent financial schemes.

Think about that.

The 2008 crash happened because Wall Street gambled away trillions with reckless subprime lending, then got bailed out while working people lost everything—homes, savings, retirement accounts. The CFPB was one of the only safeguards preventing another financial collapse from being dumped onto your shoulders.

Now it’s gone.

In a country where credit card debt has soared to over $1.13 trillion, where predatory lending already cripples millions, and where banks and financial institutions wield unchecked power, the single entity standing between you and financial ruin has been defanged. No more consumer protections. No more regulations against deceptive practices. No more accountability.

You might want to think long and hard about how you manage your finances in the coming months. This isn’t a drill. If financial institutions are no longer under scrutiny, expect increased fees, higher interest rates, aggressive debt collection, and outright fraud to go unchallenged. If you have revolving debt, start paying it down now. If you rely on credit cards for daily expenses, develop an exit plan. Your bank isn’t your friend, and soon, neither will be your government.

This is the opening salvo in an economic war on the public. You can bet your bottom dollar that payday lenders, debt collectors, and banks will waste no time capitalizing on this new freedom from oversight. They will bury people in fine print, push subprime loans, hike rates on existing debt, and revive all the dirty tricks they used before the CFPB was created.

The CFPB was never perfect, but it was at least a barrier against total financial anarchy. That barrier is gone.

This isn’t conspiracy—it’s happening right now.

Stay informed. Protect yourself. And if you haven’t already—dump your credit cards.

WHY THE CFPB HAS BECOME A TARGET FOR ELON MUSK

Since its inception in 2010, the Consumer Financial Protection Bureau (CFPB) has been a battleground between consumer advocates and deregulation proponents.

Established in the wake of the 2008 financial crisis, the CFPB was designed to shield consumers from predatory financial practices. However, its structure and regulatory reach have drawn fierce opposition, leading to renewed efforts—now championed by Elon Musk’s Department of Government Efficiency (DOGE)—to weaken or dismantle the agency.

The CFPB’s critics argue that it wields unchecked power, distorts free-market dynamics, and stifles financial innovation. Supporters counter that it has been an essential watchdog, returning billions to defrauded consumers and holding banks, payday lenders, and credit card companies accountable.

So why has Elon Musk taken a particular interest in dismantling this agency? Here’s what’s at stake:

CONSTITUTIONAL CHALLENGES:

Who watches the watchdogs?

Leadership Structure: Opponents claim the CFPB’s governance model violates the separation of powers. With a single director who (until recently) could only be removed for cause, critics argue it operates without sufficient executive oversight.

This issue was central to Seila Law LLC v. CFPB, where the Supreme Court ruled that the president must have the authority to remove the director at will—curbing, but not eliminating, concerns about its autonomy.

Funding Mechanism: Unlike most federal agencies, the CFPB is not subject to annual congressional appropriations. Instead, it draws its funding directly from the Federal Reserve, insulating it from political interference but also from legislative oversight.

Critics argue this makes it unaccountable to elected representatives. However, the Supreme Court upheld this funding model in a 7-2 ruling, solidifying its independence. (PBS)

REGULATORY OVERREACH:

Protector or Bureaucratic Dragnet?

The CFPB’s sweeping regulatory powers have made it a thorn in the side of financial institutions—particularly smaller lenders and fintech companies that argue its rules are excessively restrictive.

Efforts to cap overdraft fees and regulate digital payment apps have been met with fierce opposition. Industry groups claim these regulations exceed the bureau’s authority and stifle financial innovation.

Some critics argue that the CFPB acts as judge, jury, and executioner, with broad enforcement discretion that can crush businesses before they have a chance to defend themselves.

IMPACT ON FINANCIAL INSTITUTIONS:

Stability or Strangulation?

Some financial experts warn that overregulation could shrink credit access, particularly for low-income and high-risk borrowers. By aggressively policing lending practices, the CFPB may inadvertently discourage financial institutions from offering services to those who need them most, driving them toward riskier, unregulated alternatives.

However, historical data suggests the opposite—that the CFPB’s presence curbs exploitative lending practices without significantly reducing credit access.

POLITICAL AND IDEOLOGICAL OPPOSITION:

A Target for Deregulators

The CFPB has been a political lightning rod since its inception. Opponents—particularly within conservative and libertarian circles—see it as a prime example of government overreach, arguing that it creates a chilling effect on business and stifles competition.

Figures like Mick Mulvaney, a former acting director, have openly sought to gut the bureau from within, limiting its enforcement powers and shifting its priorities. Now, under Musk’s influence, the Department of Government Efficiency (DOGE) is moving to restructure or eliminate the CFPB, citing redundancy, inefficiency, and lack of accountability as key concerns.

This push has sparked protests from CFPB employees and consumer advocates, who argue that dismantling the bureau would strip consumers of critical protections, leaving them vulnerable to predatory financial practices.

THE STAKES: WHO BENEFITS FROM THE CFPB’S DEMISE?

While Musk’s motivations remain open to interpretation, the pattern is clear: a coordinated effort to weaken regulatory oversight under the guise of efficiency. If successful, this move could lead to:

The return of high overdraft fees and exploitative payday loans

Less accountability for banks engaging in fraudulent practices

The rise of unregulated digital finance schemes with little consumer recourse

Supporters of the CFPB argue that the bureau is not perfect, but its dismantling would be a boon to financial predators and a blow to ordinary consumers.

In short, the CFPB’s fight is not just about regulatory policy—it’s about who gets to play by the rules and who gets to rewrite them.

Sources:

Reuters. "Consumer Protection Agency CFPB Neutralized by Trump's New Chief." Reuters, 9 Feb. 2025, www.reuters.com/world/us/trumps-acting-cfpb-chief-halts-all-supervision-companies-2025-02-09.

Associated Press. "Trump Administration Orders Consumer Protection Agency to Stop Work, Closes Building." AP News, 9 Feb. 2025, apnews.com/article/1b93c60a773b6b5ee629e769ae6850e9.

Politico. "Vought Cuts Off CFPB Funding, Saying It's Not Necessary to Run the Agency." Politico, 9 Feb. 2025, www.politico.com/news/2025/02/09/vought-cuts-off-cfpb-funding-00203261.

ABC News. Consumer Financial Protection Bureau virtually shut down as DOGE, Russ Vought take over: https://abcnews.visitlink.me/49rWgw.

The CFPB Has Fallen: Prepare for Financial Carnage © Thaddeus Howze, 2025. All rights reserved.

And anyone in any form/s of financial jeopardy is now in yet far more danger of bankruptcy, homelessness, and/or other destruction of life quality, health, or life itself.